National Income refers to the value of goods & services produced by a nation during a particular financial year. Therefore, it is the net result of all the economic activities that take place during a financial year and is valued in monetary terms. It includes payments made to various resources either in form of rents, wages, interests & profits. A country’s progress can be estimated by the growth of its National Income.

According to Marshall: “The labor and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend.”

Gross Domestic Product

The total value of all the goods & services produced in a country during a particular year is known as its gross domestic product.

Further, GDP is determined at market price and is termed GDP at market prices. Various constituents of GDP are:

- Interest

- Rents

- Wages & salaries

- Undistributed profits

- Dividends

- Mixed-income

- Depreciation

- Direct taxes

Gross National Product

For GNP calculation, data of all productive activities like agriculture produce, minerals, woods, commodities, transport contribution to production, insurance companies and all professions ( lawyers, teachers, doctors, etc.) is required at market prices.

It also includes the country’s net income arising from abroad. Four primary constituents of GNP are:

- Consumer goods and services

- Goods produced or services rendered

- Income arising from abroad

- Gross private domestic income

The National Income of a nation can be measured by 3 different methods:-

- Value Added method

- Income method

- Expenditure method

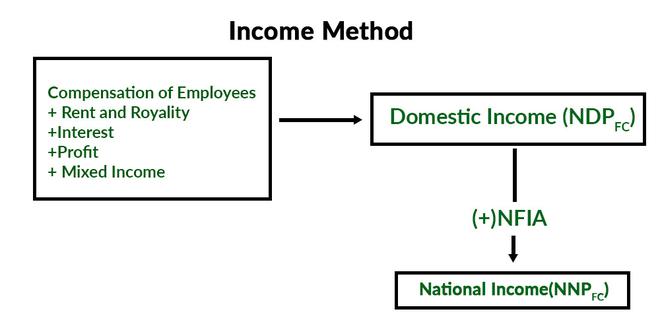

Income Method

The income method calculates the National Income based on factor incomes. The incomes received by every resident of a country for the productive services provided by them during a year are added together to determine the National Income of an economy. In other words, under the Income Method of calculating National Income, all incomes of a country accruing to the factors of production through rent, wages, profits, interest, etc., are added up together for the determination of National Income. This method is also widely known as the Factor Payment Method or Distributive Share Method.

The total of all the income earned by factors of production within a domestic territory of a nation is known as Domestic Income(NDPFC).

According to Hanson, “Net domestic Income is the income generated in the form of wages, rent, interest, and profit in the domestic territory of a country by all producers (normal residents and non-residents) in an accounting year.”

Components of Factor Income

1. Compensation of Employees (COE)

COE refers to the amount paid to employees directly or indirectly by the employer in exchange for their services. It includes all kinds of payments and benefits received by the employee, directly or indirectly.

COE consists of three elements:

- Wages and Salaries in Cash: It consists of all monetary benefits like salaries, wages, bonuses, commissions, dearness allowance, etc.

- Wages and Salaries in Kind: It includes all non-monetary benefits like health & education facilities, rent-free accommodation, free car, etc. An imputed value of such benefits should be calculated in National Income.

- Employer’s Contribution to Social Security Schemes: It consists of the employer’s contribution to the employee’s security. For example contribution in gratuity, provident fund, labor welfare fund, etc. The main aim of these contributions is to ensure employee security.

Three exceptions in the elements of COE:

- If an employee reimburses the business expenses incurred by him, it will be excluded from the Compensation of Employees. It is because these types of expenses are a part of the intermediate consumption of business enterprises.

- Wages and Salaries in kind do not include any non-monetary benefit, which is essential for work, and in which there is no discretion on the part of the employees. For example, payments for uniforms worn by employees during working hours are a part of the intermediate consumption of business enterprises.

- If a third party, say an insurance company, contributes to the social security of an employee it will not be included in COE. It is because the third party is not an employer of that employee. Besides, if an employee makes such a payment for himself, it will not be included as the employee is making the payment from COE only.

2. Rent and Royalty

Rent is that part of the factor income that arises from ownership of a land and building. Rental income includes both actual rent obtained from let-out land and imputed rent obtained from self-occupied land. The Imputed rent of a self-occupied house is calculated at the market value of that house.

Royalty refers to the income earned from granting leasing rights for self-owned assets. For example, the mineral deposits (coal, natural gas, iron ore, etc.) owners can earn more through royalty, by giving mining rights to the contractors.

3. Interest

Interest refers to the income earned from lending funds to production units. It includes both actual & imputed interest provided by entrepreneurs. Interest income consists of the interest on loans taken for productive services. It doesn’t include interest paid by one firm to another, interest paid for loans by a consumer taken for consumption, and interest paid by the government on public debt.

4. Profit

Profit is the income or reward of the entrepreneur for his contribution to manufacturing of goods & services. In other words, it is the residual income that an entrepreneur earns after paying off all other factors of production.

The profit earned is used for three purposes:

- Corporate Tax: It is the tax paid by a firm to the government for the profits earned by them in a particular period. It is also known as business tax or profit tax.

- Dividend: Dividend is the part of profit given to shareholders in their shareholding ratio. It is also known as distributed profits.

- Retained Earnings: It is that part of the profit that is kept aside as a reserve to handle the uncertain situations that may arise in a business. It is also known as reserves and surplus or undistributed profits or savings of private sector.

Profit = Corporate Tax + Dividend + Retained Earnings

Operating Surplus

Operating surplus is another term used in factor payments. It is the sum total of income from property, i.e., rent, royalty, and interest, and income from entrepreneurship, i.e., profit.

Operating Surplus = Rent + Royalty + Interest + Profit

or

= Value of Output – Intermediate Consumption – Compensation of Employees – Mixed Income – Consumption of Fixed Capital – Net Indirect Taxes

Operating surplus arises in both government & private enterprises. However, it does not arise in general government sector, as they operate for the benefit of general public. Therefore, factor income is nil in general government sector.

For example,

Calculate the operating surplus using the given below information.

Particulars ₹ in Crores Value of output 80,000 Wages and salaries 18,000 Net direct tax 7,000 Purchase of raw material 10,000 Solution:

Operating surplus= Value of output – Wages and Salaries – Purchase of raw material – Net Indirect Tax

Operating surplus = 80,000 – 18,000 – 10,000 – 7,000

Operating surplus = ₹ 45,000 crores

5. Mixed Income

It is the income generated by unincorporated enterprises, such as small shopkeepers, retail traders, etc., and own-account workers like farmers, barbers, etc. The term mixed income is used for any kind of income which has more than one kind of factor income. It arises from self-employed workers’ productive services. The income of these workers includes profit, rent, wages, and interests and can not be separated from each other. For example, a tutor giving tuitions at his residence.

Reasons for Mixed Income

- Every organization uses different accounting practices while preparing its accounts which makes it difficult for the National Income estimators to identify the components of different factors of income. Besides, the estimators do not always have the accounts of every production unit; therefore, they have to consider mixed income.

- If the total factor payments can be estimated, but can not be classified into separate heads, then an additional factor payment mixed income is added.

- This factor payment is also called Mixed income of Self-employed as this situation mostly occurs in the case of self-employed people, like consultants, chartered accountants, etc.

Steps of Income Method

Step 1

The first step is to identify and classify the factors of production of all the producing firms into primary, secondary and tertiary sectors.

Step 2

The second step of calculating National Income through the Income method is the estimation of the factor income paid by each sector. The factor income paid by various sectors are grouped under the heads: Compensation of Employees, Rent and Royalty, Profit, Interest, and Mixed Income.

Step 3

The next step is to calculate domestic income NDPFC . The total of all the factor incomes is known as Domestic Income(NDPFC ).

NDPFC = Compensation of Employees + Profit + Rent & Royalty + Interest + Mixed income.

Step 4

The last step of calculating National Income through the Income Method is the estimation of Net Factor Income from Abroad(NFIA). NFIA is added to domestic income (NDPFC) to get the National Income(NNPFC).

NNPFC = NDPFC + NFIA.

Precautions of Income Method

1. Transfer Income will not be included: Transfer incomes such as donations, charity, scholarships, old age pensions, etc., are not counted in the National Income, as these activities are not connected to any production activity and no value addition takes place.

2. Income from Sale of Second Hand Goods will not be included: Income received from the sale of second hand goods also known as capital gains is not calculated in National Income, as their original sale has already been included at the time of purchase. If these goods are calculated again, then it will lead to the problem of double counting. However, any kind of commission or brokerage received by agents on the sale of these goods will be included, as it is an income received for rendering productive services.

3. Income from Sale of Securities will not be included: Income from the sale of bonds, shares, and debentures will not be calculated, as these transactions do not contribute to the current flow of goods & services. These financial assets are just paper claims and include the transfer of title only. However, any kind of commission or brokerage on such assets is included in National Income, as it is a productive service.

4. Windfall Gains will not be included: Income that arises from windfall gains like horse racing, lotteries, etc., are not calculated in the determination of National Income, as they are not connected with any kind of production activity.

5. Imputed Value of Services by Owners of Production Units will be included: The imputed value of self-occupied houses, production for self-consumption, interest on own capital, etc., are included under National Income, as these are productive activities and add to the current flow of goods & services of the economy.

6. Payment out of Past Savings will not be included: Payment out of past savings such as interest tax, gift tax, death duties, etc., is not calculated in National Income, as they are paid out of past savings or wealth and do not contribute to the current flow of goods & services of the economy.

Leave a Reply