What is Foreign Exchange?

Foreign exchange refers to foreign currency. For example, for an Indian resident, the Indian rupee (₹) is a domestic currency that can be used as a medium of exchange in India. But the Indian rupee (₹) can not be used as a medium of exchange outside India. The currency used in other countries is treated as foreign currency for India. Therefore, in the case of international transactions, the domestic currency is converted into foreign currency. For example, if a person visits New York for vacation, he/she can not use the Indian rupee (₹) in New York for economic transactions. The person has to convert the Indian rupee into US Dollars ($), only then he/she can stay there. For that reason, it is important to know at what price domestic currency can be converted into foreign currency. This price is known as the Exchange Rate. The market in which domestic currency is traded for others is the “Foreign Exchange Market”.

Foreign Exchange Rate

“The rate at which the domestic currency can be exchanged for the foreign currency is known as Foreign Exchange Rate“. In simple terms, the foreign exchange rate is the price paid in the domestic currency (₹) for buying a unit of foreign currency. It links the currencies of different countries and enables the comparison of international prices. For example, to buy a unit of $(dollar), if you have to pay ₹60, then the exchange rate is ₹60 per dollar. It can be written in the form; of $1=₹60.

Demand and Supply for Foreign Exchange

Demand for Foreign Exchange:

The demand for foreign exchange arises when a person has to make a payment in foreign currency. In simple terms, it indicates the outflow of foreign currency. It is demanded by Indian residents for the following reasons:

- Import of Goods and Services: In the case of the Import of goods and services from a foreign country the payment is made by the importer (the person who imports goods and services) in foreign currency; thus, creating a demand for foreign exchange in India’s Foreign Exchange Market.

- Unilateral Transfers Sent Abroad: These are the transfers made by the person for free. It includes the transfer of gifts and grants sent by the government or a person to other countries. These are called unilateral transfers because they are not made to get something in return and because of this reason, foreign exchange is required. For example, If a foreigner is working in India. It means that he is earning income in Indian Rupees. Now, if the foreigner wants to send money to his family, he will have to get the currency exchanged, resulting in an increasing demand for foreign exchange.

- Tourism: To pay for expenses incurred during international tours, tourists require a foreign exchange, which creates demand for it. Foreign tourists will create a demand for foreign exchange in India’s foreign exchange markets.

- Investments: When investments are made by India in other countries foreign exchange is required. Therefore, demand for foreign exchange is created while making investments abroad.

- Lending Abroad: If India provides loans to foreign countries, India will demand foreign exchange.

- Repayment of Interest and Loans: If loans along with interest are paid to foreign lenders, there is a need for foreign exchange. It results in an increase in the demand for foreign exchange.

- Purchase of assets abroad: There is a demand for foreign exchange to make payments for the purchase of assets like land, shares, bonds, etc., abroad.

- Speculation: When people earn money from the appreciation of currency it is called speculation. For this purpose, they need foreign exchange. For example, If an Indian resident through analysis expects the price of the US Dollar to be high in the future, he/she will buy more US Dollars today. The main goal of speculation is to earn profits when the dollar becomes expensive.

Reasons for Rising Demand for Foreign Currency

The demand for foreign exchange rises in the following situations:

1. The demand for foreign currency rises because of the appreciation of domestic currency (it can also be said that there is a depreciation in the price of foreign currency). Appreciation of domestic currency refers to an increase in the value of the domestic currency in comparison to foreign currency. For example, if the price of $1 (US Dollar) falls from ₹64 to ₹60, then it means that more goods will be purchased with the same rupees. This indicates that imports from the USA will increase, as American goods become cheaper in India. It will ultimately increase the demand for US Dollars in India.

2. When the price of foreign currency falls, its demand for speculative purposes rises as now it is available at a low price.

3. A fall in the exchange rate of $1= ₹64 to $1= ₹60, increases the level of investment abroad.

4. Tourism to that foreign country increases as travelling abroad has now become relatively cheaper.

Demand Curve of foreign exchange

There is an inverse relationship between the rate of foreign exchange and demand for foreign exchange. It means the higher the rate, the lesser will be the demand for foreign exchange and vice-versa. Due to this reason, the demand curve slopes downwards. The relationship between the rate of foreign exchange and the quantity demanded for foreign exchange can be illustrated graphically with the help of a downward-sloping curve, as shown in Figure 1.

Fig 1: Demand for foreign exchange

In the graph, the exchange rate is shown on the Y axis, and demand for foreign exchange is shown on the X axis. The demand curve DD shows the negative relation between the rate of exchange rate and demand for foreign exchange. The DD demand curve (negative sloping) shows that at a lower rate of exchange OR1 more foreign exchange is demanded OQ1, whereas at a higher rate of exchange, i.e., OR2 less foreign exchange is demanded OQ2.

Supply of Foreign Exchange

The supply of foreign exchange involves receipts of foreign exchange. Thus it indicates the inflow of foreign currency into the domestic country. The major sources of supply of foreign exchange are stated below:

- Exports: Whenever the foreigner purchases goods and services from a domestic country (India), the payment is made by the foreigner in foreign exchange. Thus, in the case of Exports of goods and services, there is an increase in the supply of foreign exchange in India’s foreign exchange market.

- One-sided/Unilateral Transfers from Abroad: These are the transfers made by the person for free. It includes the transfer of gifts and grants sent by the government or a person to other countries. These are called unilateral transfers because these are not made to get something in return. Thus for unilateral transfers, foreign exchange is required. If Indians are working in a foreign country. It means they earn income abroad. When they send back the income earned to their homeland for their families in India, it results in an increase in the supply of foreign exchange in India’s foreign exchange market.

- Tourism: To pay for expenses incurred during international tours, tourists require foreign exchange. If foreign tourists come to India, then they need our Indian Rupee for their stay. They supply foreign exchange in return for the Indian Rupee which will in return increase the supply of foreign exchange in India.

- Foreign Direct Investments(FDI) in India: FDI refers to the investment made to get direct control of the domestic market. When investments are made by Multinational Companies (like Pizza Hut, and Dominos). In India, there is a flow of foreign exchange.

- Foreign Portfolio Investments(FPI) by Foreign Investors: FPI refers to the investment made to earn profit in the domestic market. These are made in form of shares, debentures, bonds, etc. Any purchase in the Indian stock exchange by foreign investors results in the flow of foreign exchange in the Indian share market.

- Deposits by Non-Resident Indians(NRI): Foreign exchange flows in the Indian foreign exchange market due to deposits by Non-Resident Indians(NRI) in India.

- Speculation: Supply of foreign exchange arises when people earn money from the foreign exchange by speculating.

Reasons for Rising Supply of Foreign Currency

The supply of foreign currency rises in the following situations:

1. The supply of foreign currency rises because of the depreciation of domestic currency (it can also be said that there is an appreciation in the price of foreign currency). Depreciation of the domestic currency refers to the decrease in the value of the domestic currency in comparison to foreign currency. For example, if the price of $1 (US Dollar) rises from ₹60 to ₹64, then it means that more goods will be purchased in rupees with the same dollar. This indicates that exports to the USA will increase, as Indian goods become cheaper in the USA. It will ultimately increase the supply of US Dollars in India.

2. When the price of foreign currency increases, the tendency for speculative gains in the domestic country rises. Thus it increases the supply of foreign exchange.

3. A rise in the exchange rate of $1= ₹60 to $1= ₹64, increases the purchases by the non-resident in India.

4. Tourism in the domestic country increases as travelling in India has now become relatively cheaper.

5. There is an increase in the level of investment from a foreign country as the purchasing power of the foreign currency in the domestic country rises.

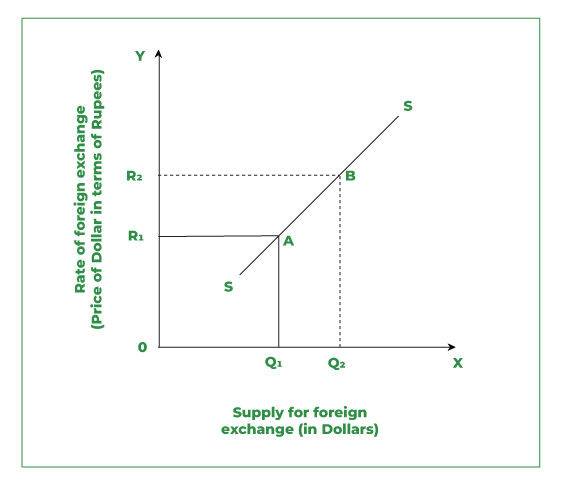

Supply Curve of foreign exchange

There is a positive relationship between the rate of foreign exchange and demand for foreign exchange. This means the higher the rate of foreign exchange, the higher will be the supply of foreign exchange and vice-versa. Thus supply curve slopes upwards. The relationship between the rate of foreign exchange and the quantity supplied of foreign exchange can be illustrated graphically with the help of an upward-sloping curve as shown in Figure 2.

Fig 2: Supply for foreign exchange

In the graph, the exchange rate is shown on the Y axis, and the supply of foreign exchange is shown on the X axis. The supply curve SS shows the direct (positive) relation between the rate of exchange rate and the supply of foreign exchange. The supply curve (positive sloping) shows that when the rate of foreign exchange rises from OR1 to OR2, then the supply of foreign exchange rises from OQ1 to OQ2.

Leave a Reply